Don’t let uncertain headlines give you the wrong impression, we are most certainly heading into a recession. With the IMF reducing their global GDP forecasts, there are tough times ahead. This can be a worrying time for business owners. But going through a recession doesn’t have to be as scary if you can prepare your business for it. Recession proofing your business today will make it much easier for you to ride out the storm ahead. This is Part 1 of TAKU’s series on recession-proofing your business.

What exactly is a recession?

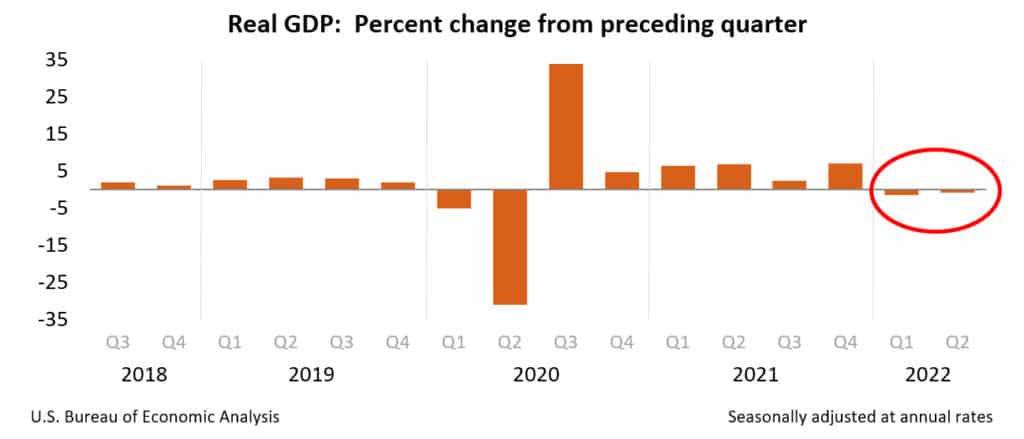

A recession is a drop in economic growth in a country for at least two quarters (or 6 months) in a row. The drop in economic growth is calculated by GDP. Some people say that GDP does not truly represent the health of an economy. However, it is still a good indicator when to expect a slowdown. If you look at the graph below, you will see that Jan 2022 to June 2022 were the first periods of economic decline since the start of the pandemic.

How can you recession proof your business?

Knowing that your business will face a decline in sales or a lack of access to outside financing, we can begin by developing a game plan to recession proof your business.

Find ways to save money during a recession

More and more businesses will have cash troubles as the recession continues. So it is crucial that you consider ways your business can save money. Here are some tips regarding saving during a recession:

Reduce unnecessary costs

As a retailer you may be paying for services and products that are not essential to your business operations. It is important to take a look at the costs for your business and figure out which things you don’t absolutely need to keep your business running.

While you will want to review every single expense, it’s important to remember that the best way to stay profitable is to focus more on tools or services that help you sell more or save more money. This means, if you have to decide between buying a scale or running an ad campaign, you’re better off spending on digital marketing to keep sales up and possibly even grow market share when your competitors are pulling back.

Renegotiate for the recession

One of the few good things during a recession is that demand will fall on things such as marketing spend. This can be good for your business as your competitors are spending less while it will cost you less to run ads.

At the same time, as demand for some services or products fall, when it’s time to renew a contract, make sure to try to negotiate for better rates or at least lower increases during these inflationary times.

Reduce higher interest debt

Debt is often unavoidable when you’re running a business. But in these times of higher interest, all debts aren’t equal. Make sure that you’re familiar with the interest rates, fees and due dates associated with the debt you’re carrying. When paying down debt, always pay down higher interest debt such as credit card balances first to minimize the amount of interest you’re paying.

Reconsider big one-time investments

Look at return on investment

Investments are always necessary to maintain and grow businesses. But similar to what we’ve said about debt, all investments aren’t the same. The most important thing for any investment is to consider the return on investment. Return on investment refers to how long it will take for you to recover the cost of the investment. And usually ROI is best on purchases that help you optimize profitability by increasing sales or reducing your operational costs.

Pay monthly instead of upfront

Another thing to consider is whether or not what you’re looking to purchase is available on a monthly basis. This is particularly true with technology solutions. While it can appear to be cheaper to make a one-time purchase when buying software, the reality is that technology moves quickly and technology solutions that charge on a monthly basis offers a number of benefits:

- Significantly lower upfront costs. In these inflationary and recessionary times, cashflow is king.

- Constantly updated technology so that you always have access to new features that work with the latest devices. “Resilience” was a keyword during the pandemic. And a recession is just as uncertain for businesses. Having the ability to adapt your business with the latest, flexible technology might be key to your survival.

- The ability to try technology to make sure it is right for your business. Most installed software cost the equivalent of several years of subscriptions. And if you’ve paid that much money upfront, you won’t be able to switch even if it’s not working out.

Use automation to reduce operational costs

Everybody has heard about the staffing shortage in the retail industry after the pandemic. With record high inflation, hiring staff is only getting more expensive. Where possible, consider using automation technology to reduce operational costs. For example, if you’re a busy store, solutions such as self-checkout kiosks are an easy way to lower operational costs while improving customer experience and sales by speeding up lineups.

Understand consumer needs

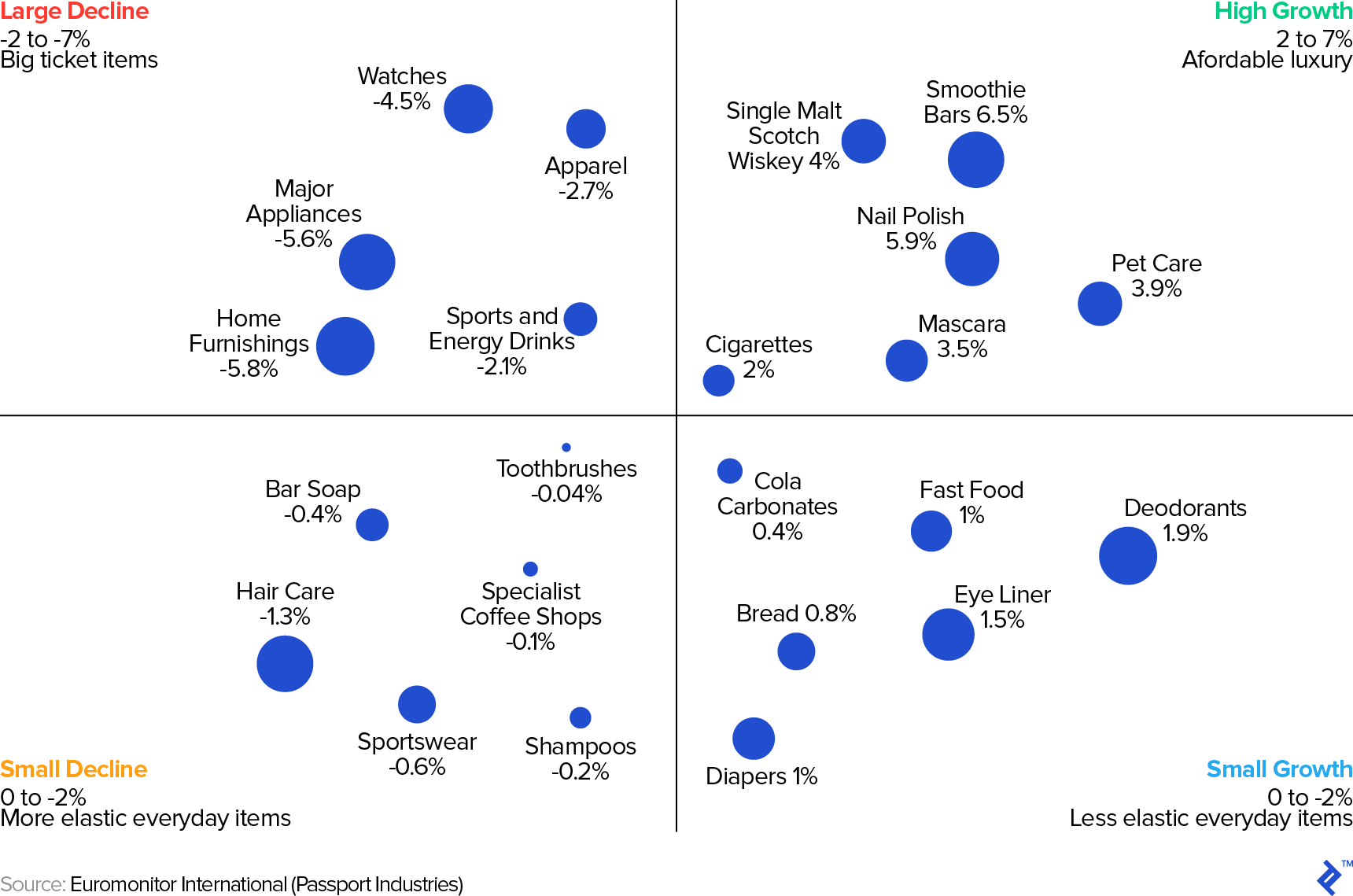

The businesses best able to thrive during a recession are those that are constantly aware of what their consumers are looking for. Even though overall demand will decline during a recession, there are product or service categories where demand may stay the same or even increase. This happened during the pandemic and it will happen again during a recession as shoppers change their buying habits.

Recession-proof products and services

The most recession-proof products are the types consumers will always need. Things such as food and energy will always be in demand. Normally speaking, businesses selling non-essential items will have a harder time. The interesting thing with the current recession is that there is also a trend of shoppers looking for ways to improve their lives after several years of pandemic restrictions.

The best example of this are products with “lipstick effect”. When shoppers do not have enough money to spend on big-ticket luxury items, many will find the cash to purchase small luxury items, such as expensive lipstick. So while it can be expected that shoppers will spend less overall on “discretionary” products, they will spend money on things that increase their standard of living, especially if they are good value for money. In Part 2 of our Recession-Proofing Your Business series we will take a deeper look into current retail product trends and how retailers are successfully marketing products during a recession.

Trim your inventory

As mentioned, lower sales lead to more unsold stock on shelves. When you’re carrying more inventory, you will need to deal with more theft, damage, obsolescence, and increased storage costs. You will need to get on top of this by:

- Clearing as much deadstock as possible.

- Purchasing products your customers are more likely to buy. Do this by staying on top of any changes in your shopper buying patterns. This means tracking your top sellers on a weekly or monthly basis to see. For example, buying products more likely to have the lipstick effect such as home spa kits is always a smart move during a recession.

- Stocking less seasonal products unless you are sure that they will sell. The selling time for seasonable products is more limited vs. products that can be sold year-round.

- Have a good relationship with your suppliers to optimize your purchasing lead time. As a retailer, it’s important to have products in stock when shoppers want to buy them. But you don’t want to stock too early or too late to avoid locking in your cashflow or not having products to sell. As the supply chain problems during the pandemic start to improve, make sure you’re working with your suppliers to receive products when you need them. Depending on their own situation, good suppliers will try to work with you, especially during a recession, as their business depends on your own success.

Opportunities for growth

Expand revenue streams

Consider your existing operations. Are there ways you could add new sales channels or add products to generate new revenue? A few ideas you could consider include:

- Adding more recession-proof products

- Distributing to other retailers if you make your own products

- Selling online or on social media yourself

- Starting an online store under a different brand to sell only discounted or clearance items

The important thing to remember here is that additional revenue streams are incremental sales. As long you’re not adding a lot of extra overhead costs, they generally have the lowest marginal cost as you would not have made those sales anyways.

Power in numbers

Partnerships and alliances with other businesses can help strengthen your business. You can reach out to other businesses and see how you can help each other during a recession. Partnerships can help make your offerings more attractive to customers. For example if you sell homemade soaps, you could reach out to a local business to start selling from their store or sell kits together with them. This way you have more products to sell and/or another way to reach new customers cost-effectively.

Client relationships

Take the time to really deepen your bond with your customers. Focus on providing excellent customer service to improve loyalty. Obviously this is an important strategy during all economic conditions, but during a recession it can really help you keep your business afloat. Studies have shown that shoppers have continued to support local businesses more even after pandemic restrictions ended. When customers are loyal to you they will continue to shop with you despite hardships.

Adapt to meet new customer needs

There will be tough times ahead for all types of businesses. But this does not mean it is all doom and gloom. Smart entrepreneurs will look for ways to make their business more resilient by optimizing their operations, pivoting based on consumer needs, and even finding ways to grow. You should take some time and evaluate your business’ position. If you are able to make good decisions during this time you may just come out of this recession better than before.

To stay up to date with all things retail, including the next part in our Recession Proofing Your Business series make sure you subscribe to our blog. Click or tap on the banner below to subscribe today!