Canadian GST/HST Tax Relief

Updated on December 13, 2024

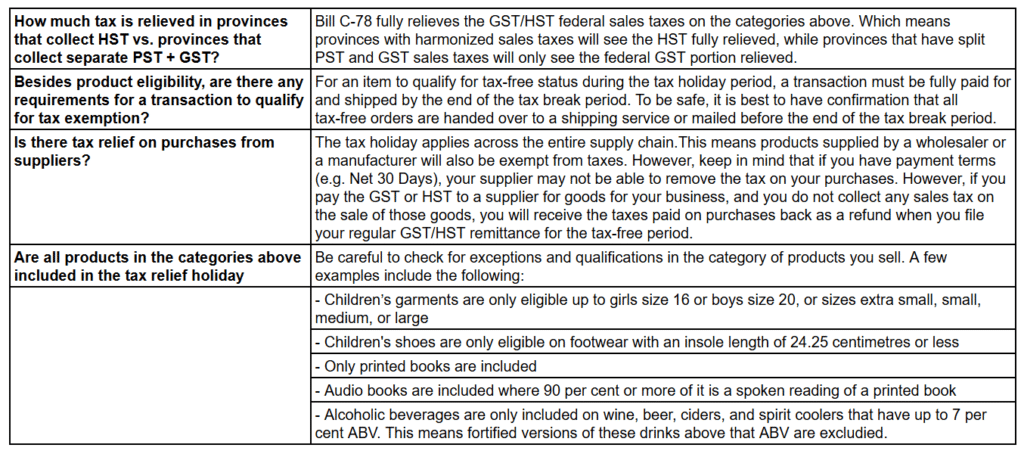

The Canadian federal government’s legislation for temporary GST/HST sales tax relief, running from December 14, 2024, to February 15, 2025, received royal assent last night. While Bill C-78 is now law, updated guidelines have not yet been released. Retailers should rely on the details currently available to ensure compliance during the relief period.

Based on the November 27, 2024 press release, the following items will be exempt from GST or HST during this timeframe:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches;

- Restaurant meals, whether dine-in, takeout, or delivery;

- Snacks, including chips, candy, and granola bars;

- Beer, wine, and cider;

- Pre-mixed alcoholic beverages below 7 per cent ABV;

- Children’s clothing and footwear, car seats, and diapers;

- Children’s toys, such as board games, dolls, and video game consoles;

- Books, print newspapers, and puzzles for all ages; and,

- Christmas trees and similar decorative trees.

For the complete list of eligible products, refer to this backgrounder published by the government for the most recent list of Qualified Goods.

How Does the Tax Relief Program Impact Your Business?

The GST/HST Tax Relief Program temporarily removes GST/HST from certain product and service categories. To comply, Canadian merchants must update their tax settings in TAKU or VitaHealth to reflect these exemptions for the duration of the program.

FAQs

How to Prepare for the Tax Relief Period

To help you get ready, we’ve put together a detailed step-by-step guide. Here are the three essential actions you’ll need to take:

- Identifying the exempt categories applicable to your business

- Adjusting your POS tax settings to comply with the program

- Ensure proper tax reporting during and after the program period, particularly, during December and February which are both partially exempt based on the start and end date of the program. If possible, we recommend checking more closely and keeping track of any returns processed during and after the tax relief period. You will want to make sure that the sales taxes applied or exempt on the original sales transaction are also reflected in the return transaction.

Tax Relief Instructions

TAKU and VitaHealth POS have separate tax categories to handle tax exemptions.

If your inventory is already organized by product categories, the simplest way to implement the GST/HST tax relief changes is to create specific “tax categories” and updating the tax categories for products in each product category.

1. Create Tax Categories that will be used in tax rules that exempt taxes

2. Enable Tax Categories in products.

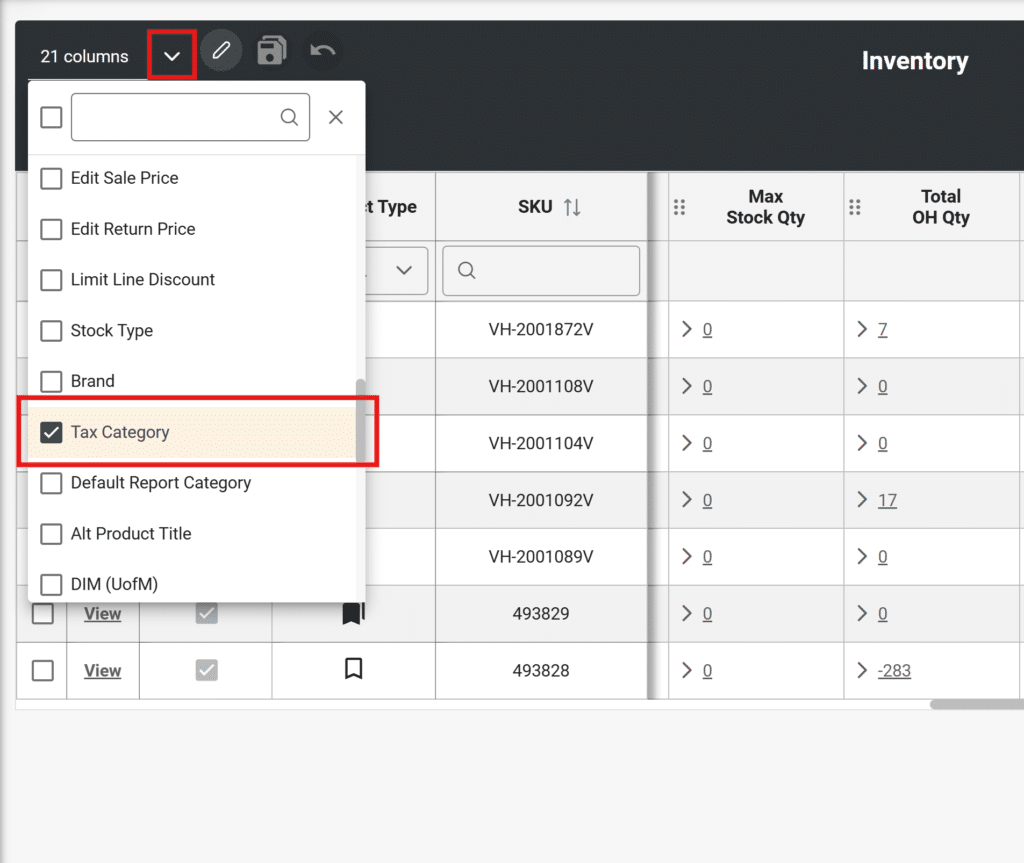

a. Load your inventory list (Inventory > Inventory List)

b. Make sure Tax Category is a visible column in your inventory list

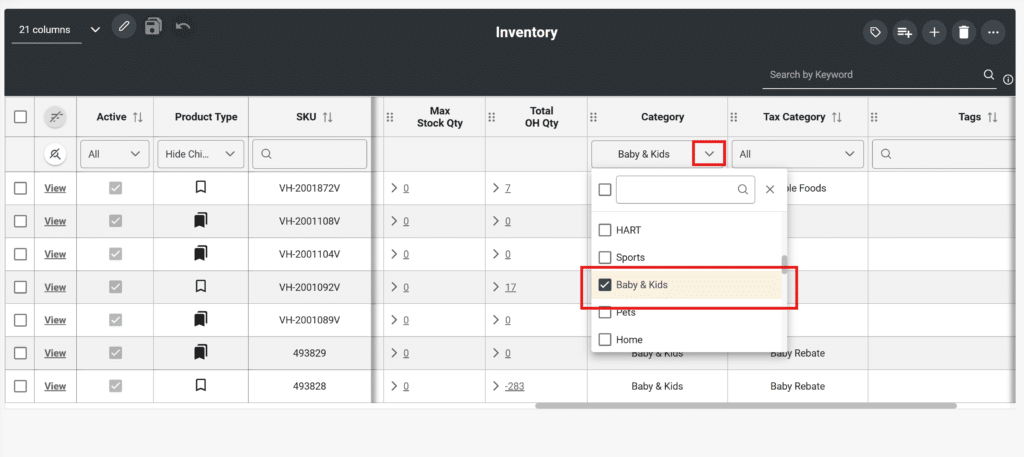

c. Filter your product Category column by the product categories that are eligible for the tax relief program

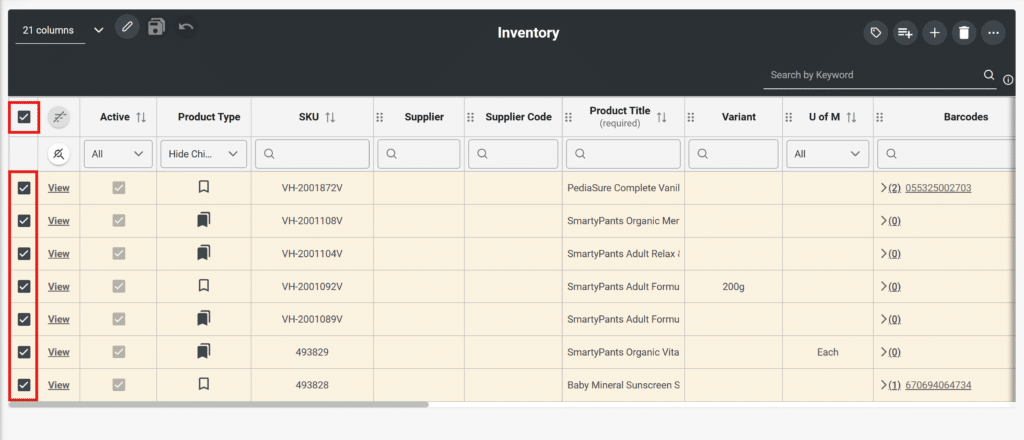

d. Select all of the products you would like to have enabled for tax exemptions

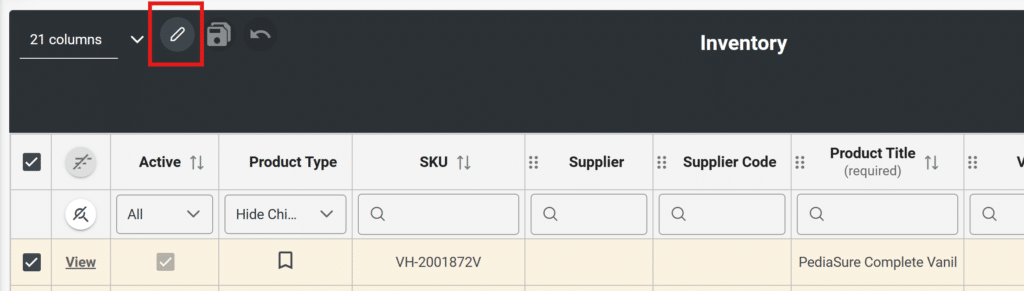

e. Turn on Edit Mode by clicking on the pencil in the top left of the inventory list header

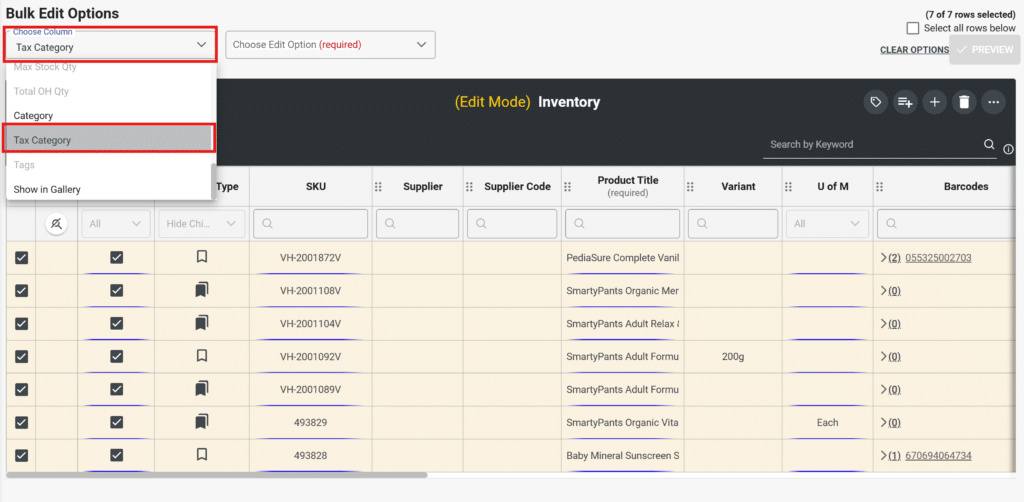

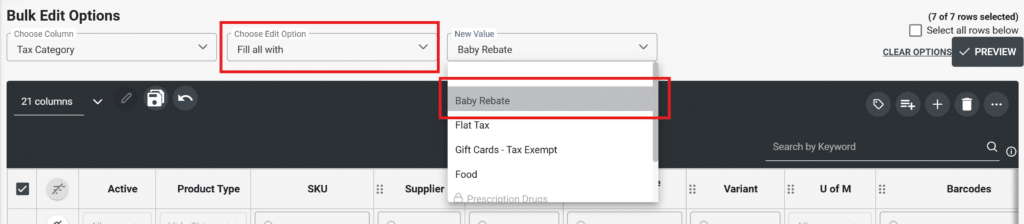

f. Use the Bulk Edit function to select the Tax Categories required

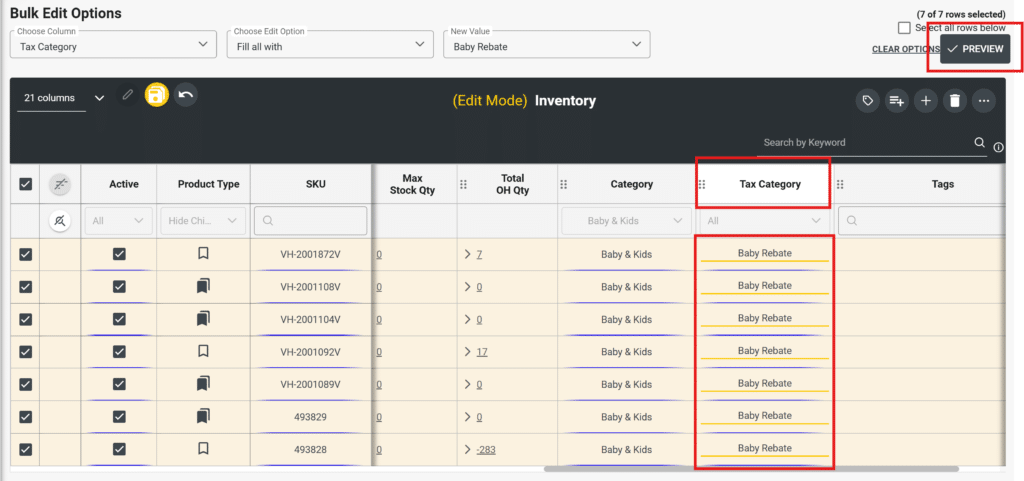

g. Click Preview to see the changes in the Tax Category column

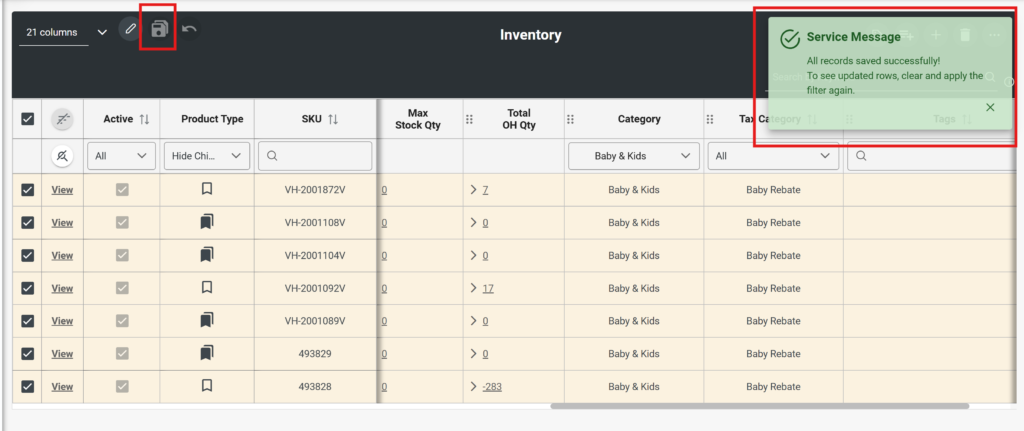

h. Click the yellow Save button. Make sure you see the green confirmation message so you know your changes have been made

3. Apply Inventory Tax Exemptions so specific products are exempt during every sale

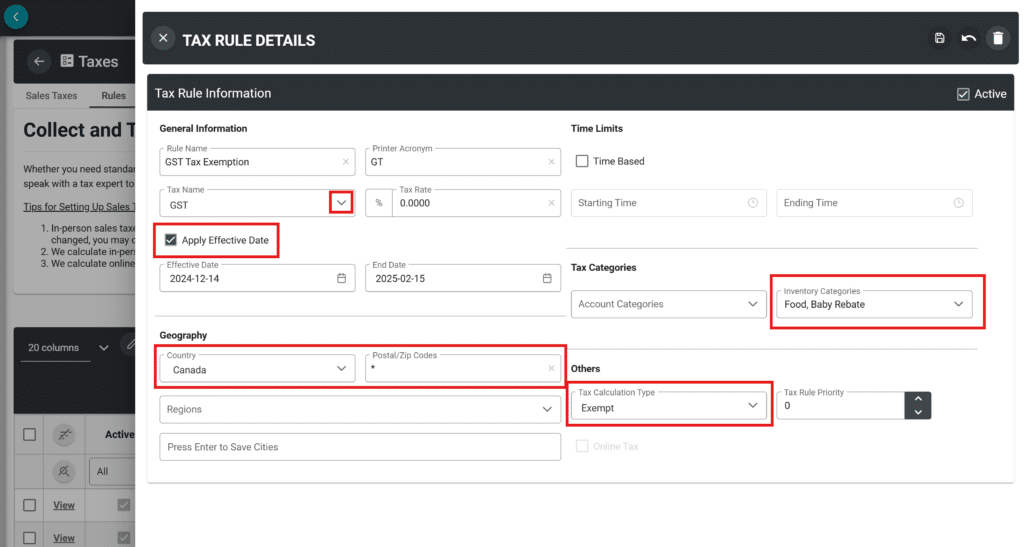

a. Create the GST or HST Tax Exemption in the Sales Tax Rules section (Settings > Business Settings > Taxes > Rules)

When creating the new rule, make sure to include settings for the Effective Date, Geography, Tax Inventory Categories, and the Tax Calculation Type.

Note that you are creating a new exemption rule that applies to an existing Sales Tax (e.g. GST or HST), so it will need to be selected in the Tax Name field. Also make sure that your new rule is enabled as Active in the top right corner of the Tax Rule. Note that tax rules are active only if they within an Effective Date period or have no Effective Date. If there is no effective date, it is assumed, there is no time restriction. And even if a rule is Active, if it is outside of the Effective Date, it will not be applied.

It is optional to set a rule priority if there are multiple tax rules applied to the same sales tax (e.g. you have existing Account-based tax rules). 0 is the highest priority meaning it is applied first and 1 is applied after and so forth.

We’ve designed the instructions to be clear and easy to follow, but if you have any questions about implementing these changes, our support team is here to help. Active customers can reach out to us at help@takulabs.io for assistance with tax relief updates. To keep phone lines free for urgent till issues, we encourage you to use email for these inquiries.

Don’t Wait—Update Your TAKU or VitaHealth Settings Before December 14, 2024

The tax changes take effect on December 14, 2024, and remain in place until February 15, 2025. Preparing ahead of time will ensure your operations run smoothly and remain tax compliant.

Thank you for trusting us as your retail POS partner.