One of the most common methods of payment in both traditional and online retail is payment by credit or debit cards. This is particularly true since the pandemic started as more and more shoppers are looking to avoid touching cash and prefer to pay with contactless payment options. After all, card-based payments are reliable and trustworthy ways to accept payments easily. But there are a lot of things to consider when choosing a new payment processor. Here’s what retailers should consider to minimize their costs when signing up with a new card processor:

Type of Payment Options

The type of retail business you have determines the way in which you take payment. There are 3 general types of payment options:

- Card Terminals (EMV PIN Pads) for merchants to accept in-person payments

- Virtual Terminals for merchants to manually accept payments with the card payer present (e.g. phone or fax payments)

- Payment Gateways for customers to make payments themselves in the shopping cart of an online store (e.g. PayPal, Bambora, Stripe, etc.)

Each of these types of payments can be supplied by the same or differing payment processors but they each have different rates. Generally speaking, card terminals have the lowest rates and are considered the most secure because the card holder must be present and / or provide verification with a PIN code. Remember that magnetic stripe readers are not EMV compliant and only chip-and-PIN terminals protect the merchant against chargebacks.

Expert Tip: While card terminals are EMV compliant and do protect merchants against chargebacks, this is usually only for in-person payments made using chip-and-PIN. Since the pandemic started, more and more retailers are offering contactless (tap) payments. But if you do accept contactless payment as a merchant, you should always check your payment processing policy to see if tap payments have chargeback liability. Many processors do not cover tap payments and so merchants may be on the hook for any chargebacks on such payments. This is why many merchants have a tap limit and it is definitely something a merchant should check if they’re thinking of increasing their tap limit.

Virtual terminals have higher card rates than card terminals but they are still generally lower than payment gateways. Merchants should keep in mind that virtual terminals still open the merchant to chargeback liability. The best way for retailers to minimize the liability exposure is to make sure that there is a customer-signed order agreement and for the merchant to collect as much verification information as possible such as billing address, etc.

Finally, there are payment gateways. This is the payment option for e-commerce which generally has the highest fees as it’s considered the highest risk of the 3 options. Similar to virtual terminals, online payments are liable to chargebacks. Merchants selling online should always check with their gateway payment provider for their chargeback policies and how they can best protect themselves from them.

Types of Payment Processing Fees

Even when you know what payment options work for a retail business, various processors will have offer different types of processing fees:

- Flat % Fee + ¢ per transaction

- Interchange Plus % + monthly fees

- CAD vs. Foreign Currency

Credit card processing fees often range between 1.55%-4% with variable rates from Mastercard, Visa, Discover and American Express. Some credit card processors charge more for particular credits cards (eg. American Express) because American Express relies more heavily on merchant swipe fees and annual fees rather than interest rates (that most other processors make money on).

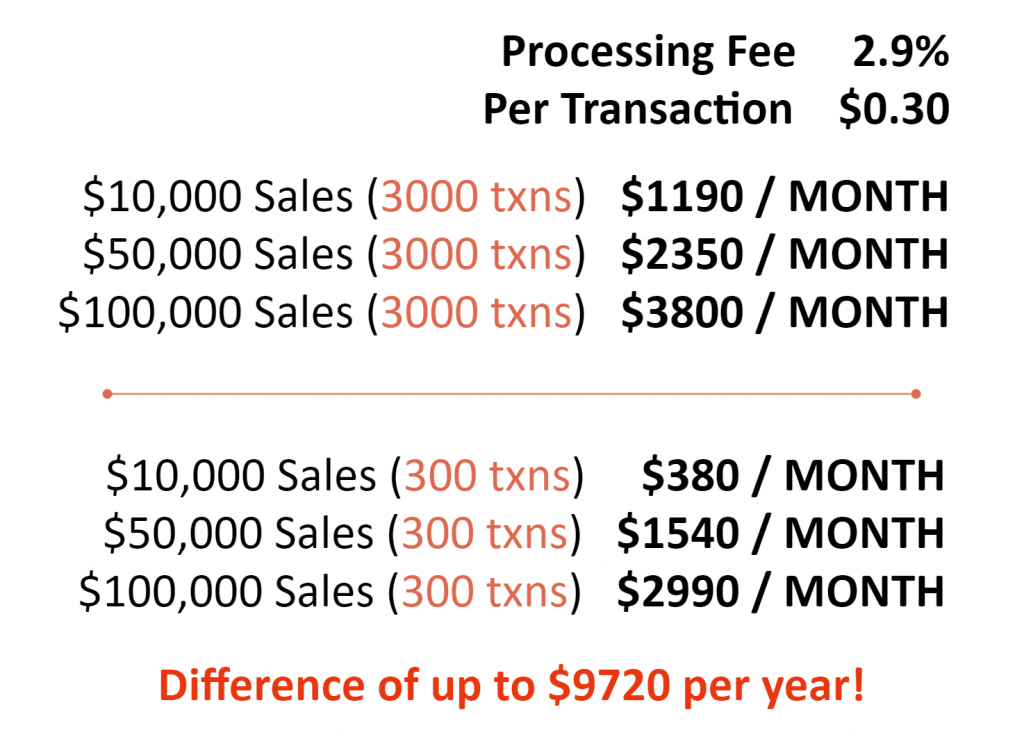

Everything else being equal, merchants should compare different processing fees based on three factors:

- The average number of transactions per month

- The average dollar value of every transaction

- The total value of all sales processed per month

Here’s an example of how processing fees can be dramatically different based on variations in the 3 factors above. Merchants should always compare the rates between processors before signing a new processing agreement.

Expert Tip: While Interchange Plus rates often work best for retailers with fairly high processing volume (e.g. $1M+ annually), it’s important to consider the type of clientele a merchant has. This is because Interchange Plus processing fees charge different rates based on the type of cards used (e.g. gold cards cost merchants more than standard credit cards). As such retailers who sell luxury or high-end products may be better off with a flat % monthly fee if the majority of their clients are customers with premium or foreign currency cards.

POS Payment Integration

Traditionally, merchant processing is handled separately for in-store and online payments. While this is changing now with a few all-in-one payment solutions coming out, besides the overall cost of the processing fees, the biggest cost to managing retail payments is the amount of resources required to track payments against sales.

After all, reconciling payments received is key to making sure that all funds are received and to quickly find out when there are any operational issues that need to be addressed immediately (e.g. suspicious employee behavior, high refunds, etc.)

This is why more and more retailers are looking for POS that can handle their preferred payment processor whether for online or in-store payments. Having payments automatically recorded in the POS minimizes human error and increases checkout speed which is important for stores with higher traffic.

Individual merchants will value different features but, generally speaking, the more established the retailer, the more important it is for the merchant to minimize sales-based fees that take a percentage of sales. While some software solutions have low (or even no) monthly costs, it’s usually because they charge higher than average % fees and / or restrict you from choosing other payment options by charging additional transaction fees on top of the regular payment fees. Others like TAKU Retail charge a flat monthly software fee with no additional sales-based % fees.

Other things to look out for in a retail POS is whether it allows refunds in-store regardless of where a payment is received. Many systems were designed to accept sales separately from different sales channels. As such, it can be a hassle to manage returns and accept refunds in separate systems. Systems like TAKU Retail allow merchants to manage even online returns with store-based refunds or exchanges. This allows merchants to not only encourage exchanges instead of refunds to avoid losing the entire sale, but it allows merchants to refund with lower cost payments options such as cash or debit as many payment processors charge the same rate for refunds as for sales.

Other Things to Consider

Retailers also need to be wary of other a few other factors when choosing their credit card processors to ensure that they are well-protected and aware of the real cost:

- The amount of time required (withholding period) for funds to be deposited into the company bank account.

- Whether processing fees are deducted upfront (Net Deposits) or at the end of every month (Gross Deposits) – net deposits can be harder for bank reconciliations as the original sales amounts won’t be on monthly statements.

- Whether payment processing statements are all-in-one or separate for different sales channels.

- Whether there are additional monthly fees and minimums.

Want to read more articles? You can find our latest article on retail shrinkage here