Every store owner knows that cash is king in retail. For obvious reasons, good cash flow management allows retailers to survive and thrive. It gives them the ability to purchase stock at the right time, negotiate better payment terms, deal with an emergency, hire more engaged employees, improve store merchandising, and generally reinvest back into the business.

But due to the complexities associated with running a retail store (inventory, seasonality, competitive promotions, etc.) unexpected costs can arise – and when this happens, many retailers find themselves in a cash crunch. A cash crunch can be defined as a situation in which a business does not have enough money to operate efficiently.

If you find yourself in this position, don’t panic. Below are some steps you can take to get back on track and free up cash in your retail business!

What is cash flow?

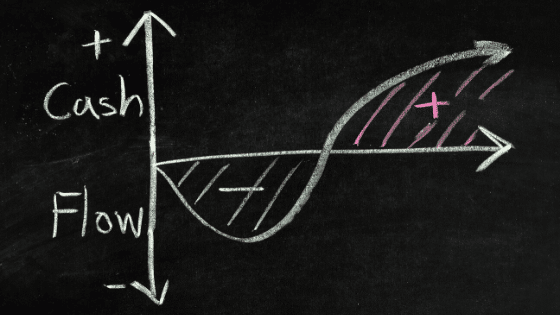

Cash flow refers to the money going in and out of a business. For a retail store, cash inflows (incoming money) include product sales while cash outflows (or expenses) consist of payroll, marketing, inventory, rent, operating expenses, etc.

If you have more money coming in than out, then your business has a positive cash flow. If the opposite is true and you have more money going out than coming in, that means you have a negative cash flow.

It’s important to remember that a business’ cash flow should not be confused with profit – cash flow represents the amount of liquidity that is available to a business at any given time. Profitability is an accounting concept which, if you are using accrual accounting methods, may not be in sync with your cash flow. For example, it is possible for you to be profitable (and therefore owe taxes according to the way you incur sales) but still be cash flow negative. As you can imagine, negative cash flow will quickly cause problems for a business if there are no financing options available for you to pay ongoing overhead costs such as rent or payroll.

4 ways to improve cash flow

1) Stay on top of customer invoices

Getting your customers to pay you on time is key to increasing your cash flow. While it is easier said than done, here are some practical invoicing tips:

- Give out incentives to pay earlier: Many business owners offer their customers discounts for paying before a certain date. This helps incentivize customers to pay faster which means better cash flow for you. Along the same lines, you can also charge a late payment penalty for those who do not pay on time.

- Make it easy to accept immediate payment: More and more businesses accept credit cards for even high value or B2B sales now. While there can be fairly high processing fees to accept electronic payment, cash in hand is often still worth the fees as it reduces the risk of non-payment or late payments. Similarly, you can utilize payment services such as After-Pay, Klarna, Sezzle, Affirm, etc. These so called “lay-buy” services allow shoppers to buy now and pay in several interest-free installments. The benefit for the merchant is that the service will pay you upfront vs. a traditional “layaway” where the customer picks up the item at the end of the term once the entire purchase is paid off. As expected, deferred payment for the shopper generally increases overall sales, particularly with those that don’t have credit cards, and it will allow you to book the sale much earlier, but remember that as the merchant, you are paying a significant fee for this service (usually slightly higher than credit card processing) so make sure to shop around as different companies offer different rates and terms.

- Send invoices right away: If you don’t send invoices, you can’t get paid. So make sure you stay on top of on-account sales and any unpaid invoices. Remember – the faster you send invoices out, the faster the cash comes in.

- Send customers invoice reminders: It’s good practice to send friendly email reminders to your customers a week before the invoice is due, the day it’s due, and a few days after. If they still haven’t paid, it may be time to give them a call. But always make sure to include a copy of the invoice and the payment options in your email to make it easier for customers to pay.

2) Review payment processing fees

While electronic payment is important to increase convenience for shoppers, retailers should regularly examine their credit card service fees. Payment processors operate in a very competitive marketplace. It’s a good idea to do your due diligence, understand your contract terms and get estimates and quotes for your processing rates. This way, you can ensure that you are not paying more than you need to. If you process a decent volume of card transactions monthly (e.g. over $100,000 worth), make sure that you negotiate for better rates before signing any contracts.

Expert Tip: Make sure you check and understand the chargeback policies for your processor. Chargebacks (reversals on charges by the processor based on claims by the shopper) can quickly add up if you are not protecting yourself (e.g. have CCTV at your checkout till as evidence to dispute a chargeback) or using methods of payment that minimize your risk (e.g. only EMV-compliant chip & PIN terminals protect you from chargebacks).

3) Take a look at your operating expenses

Cash flow management isn’t just about getting more cash to come into your business. A big part of good cash flow management is reducing the amount of cash that is going out of your business.

For retailers, the largest monthly expenses tend to be payroll, rent, insurance, and inventory. A failure to properly manage any of these cash outflows can pose a serious threat to a retail business. Below are some tips for reducing these operating expenses:

Payroll: You don’t ever want to pay your staff to sit and watch people pass your front door. If you have a few years of sales history, make sure to keep an eye on your peak and slow periods. Make sure to create your employees and assign tasks (marketing, outbound sales calls, cleaning, repair etc.) based on the expected needs of your business, not simply ease of scheduling.

Insurance: Insurance can represent a big chunk of your expenses in a given month. Due to the competitive nature of the industry, it would be wise to seek out comparative quotes and consider larger deductibles (whatever you can reasonably afford in an emergency) to reduce your ongoing premiums.

Inventory: As the largest asset for a retail business, many retailers have their cash flow tied up in inventory. Even if you are a guideshop or an online business, unless you’re only dropshipping, you will have to draw from your store inventory or warehouse stock. That’s why careful inventory tracking and management is key to good cash flow management for every retailer or wholesaler. For a good overview of inventory management essentials for retail click here. While it’s possible to use back office software just to manage inventory, it’s always ideal to use a retail POS system with built-in inventory management features that can help you ensure that the inventory you are buying is actually selling and therefore make smarter buying decisions moving forward.

4) Have a cash reserve

There comes a time where every business experiences a cash flow shortfall. It may be due to a delayed payment of a large invoice, an unexpected personal emergency, or it could just be bad weather affecting your sales. Whatever the case may be, it’s imperative to have financial resources in place in case your business experiences a cash crunch.

While some say it’s good practice to have two months of expenses saved up as a cash reserve, the fact is, you don’t want to have funds sitting in a regular bank account, not earning you any return. If you are able to set aside some cash, it’s always best to look at higher-interest savings accounts or short-term investments that will still allow you to withdraw funds if they are needed suddenly. Make sure to check with your tax accountant to make sure it is worthwhile though – various countries, states and provinces tax business investment or interest income differently.

If it’s not possible or you don’t want to put aside such a large cash reserve, you can also consider financing options such as line of credits (LOCs) or small business loans. While the idea of owing money may make some retail owners nervous, it’s important to remember that you may not be able to qualify for a loan when you actually need it. Most LOCs or SMB loans don’t charge interest until you actually draw on the funds so as long as you only keep these options for emergencies, these can be good tools to smooth out cash flow fluctuations. Similarly, always check with your local business association to see if there are any government programs available to help with small business financing. Generally speaking, low risk financing programs to support small businesses are available at all levels of government.

We hope you found this article helpful.

Subscribe to our blog for more retail tips.

In the meantime, you can join our beta waitlist here.